August 16, 2022

August 2022 SBA 504 Funding Rate:

The real estate 504 rates decreased this month. The 25 year and 20 year rates decreased by 13bps and 16bps, respectively from the month prior. The 10 year equipment rate remained as-is from July, as it adjusts every two months.

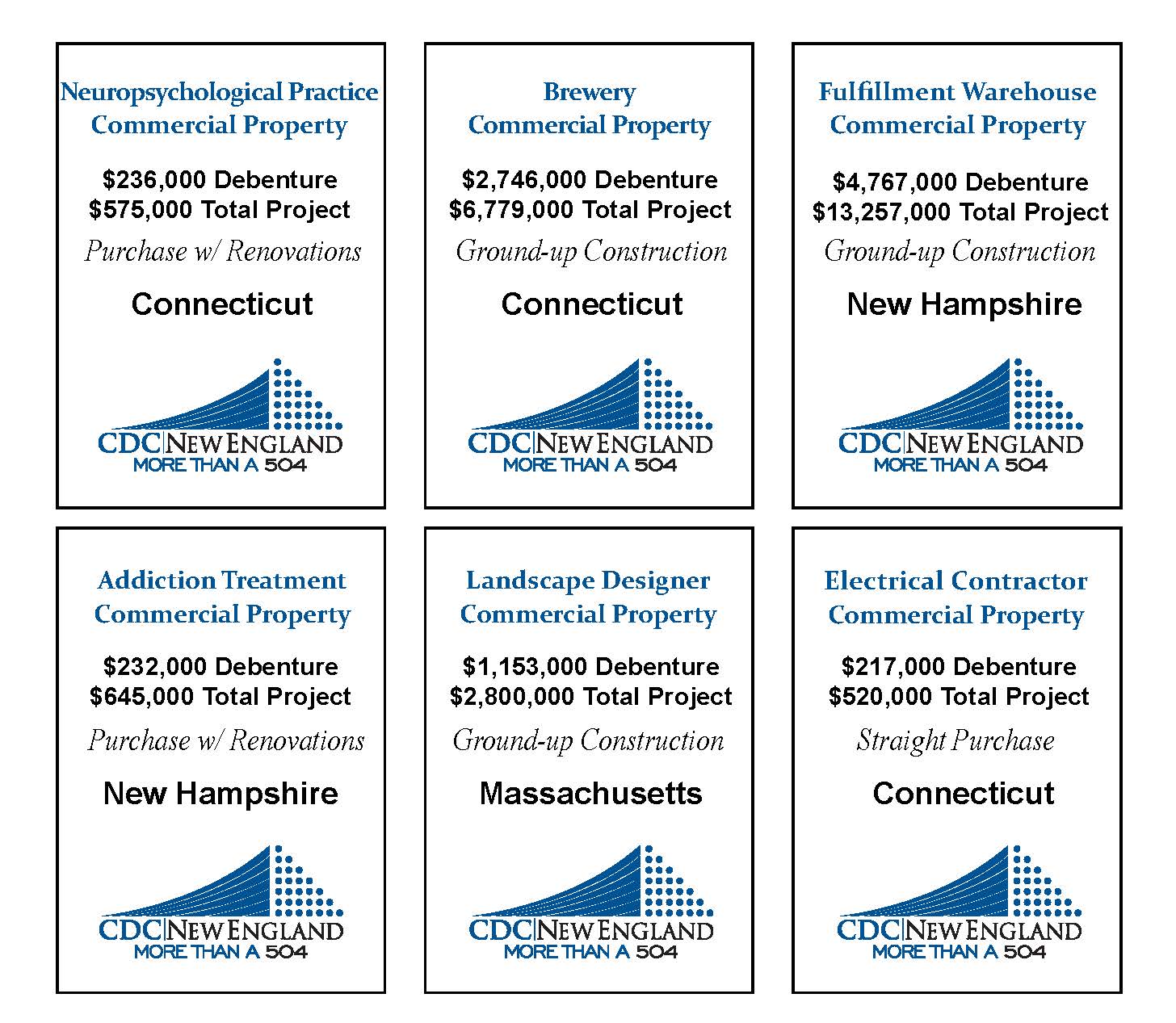

Recent SBA 504 Deals from CDC New England:

SBA 504 Term Loans:

- Long-term loans for purchasing land and buildings, new construction, renovation and leasehold improvements, machinery & equipment

- Lowest cost; low rate fixed for 10, 20, or 25 years

- Down payment financing, if needed

- Bridge financing available

*Note Rate 3.845 + 1.3475 servicing spread (25 years)

*Note Rate 3.708 + 1.3475 servicing spread (20 years)

*Note Rate 3.556 + 1.3475 servicing spread (10 years)

*For Loans Approved After 10/01/21

Contact CDC New England:

Paul F. Flynn, Jr., President & CEO

(781) 928-1133

(617) 921-2695 (cell)

Mike Topalian, Managing Director

(781) 928-1122

(508) 612-5661 (cell)

Dave Raccio, Senior VP of Sales & Marketing

Territories: Connecticut, Western Massachusetts & Vermont

(860) 218-2901

(203) 780-1097 (cell)

Carol Brennan

Territories: Massachusetts, Connecticut, & Rhode Island

(781) 928-1123

(413) 237-6648 (cell)

Nancy Gibeau

Territories: Massachusetts, Connecticut, & Rhode Island

(508) 254-7891 (cell)

Ryan Johnson

Territories: Massachusetts & New Hampshire

(781) 928-1132

(617) 762-6708 (cell)

Matt Brothers

Territories: Central/Western Massachusetts, Vermont, Connecticut, & New Hampshire

(781) 928-1124

(603) 512-3411 (cell)

Lauren Angat

Territories: Connecticut, Western Massachusetts, Vermont, & Southern New Hampshire

(860) 299-6025 (cell)